Change Is Not Always Progress, but Progress Often Requires Change

BY MIKE IVERSON, IIAG PAST PRESIDENT AND CEO OF M.D. IVERSON GROUP

This article was originally posted in IIAG's Magazine, The Dec Page Quarterly (Winter 2023). You can view the original article here.

Georgia Insurance Agents and consumers of insurance are facing increasing rates as well as the degradation of terms and conditions within insurance policies. As the seventh largest insurance marketplace in the nation, Georgia accounts for $29 billion in written premium, of which $15.5 billion is written through the independent agent channel. Even with this large market, we have begun to see insurance companies leave the state or decrease their appetite for business in our state. The bottom line is that the health of our Georgia insurance marketplace is showing the strain.

Policymakers are asking why rates are climbing and coverage terms are degrading, and what can they do about it? Some are tempted to blame insurance companies and to cry out for "rate regulation" or "mandates." Industry veterans have lived through hard markets and know these strategies may only make things worse. It is my hope that I can help lay out a variety of factors that are driving the rapid changes in our environment as well as help you explain to the people around you what is taking place.

Before we start, it is important that we acknowledge a few fundamental truths about the industry:

- Insurance is an important component in our economy and critical for consumers.

- Insurance companies choose where they want to do business and deploy capital just as any other responsible business owner would do.

- Historically, Georgia has been a very competitive marketplace with an abundance of insurance carriers providing products in our state.

- Something has clearly changed, and the Georgia insurance marketplace is in turmoil.

The Size of the Georgia Market and the Role of the Independent Agent

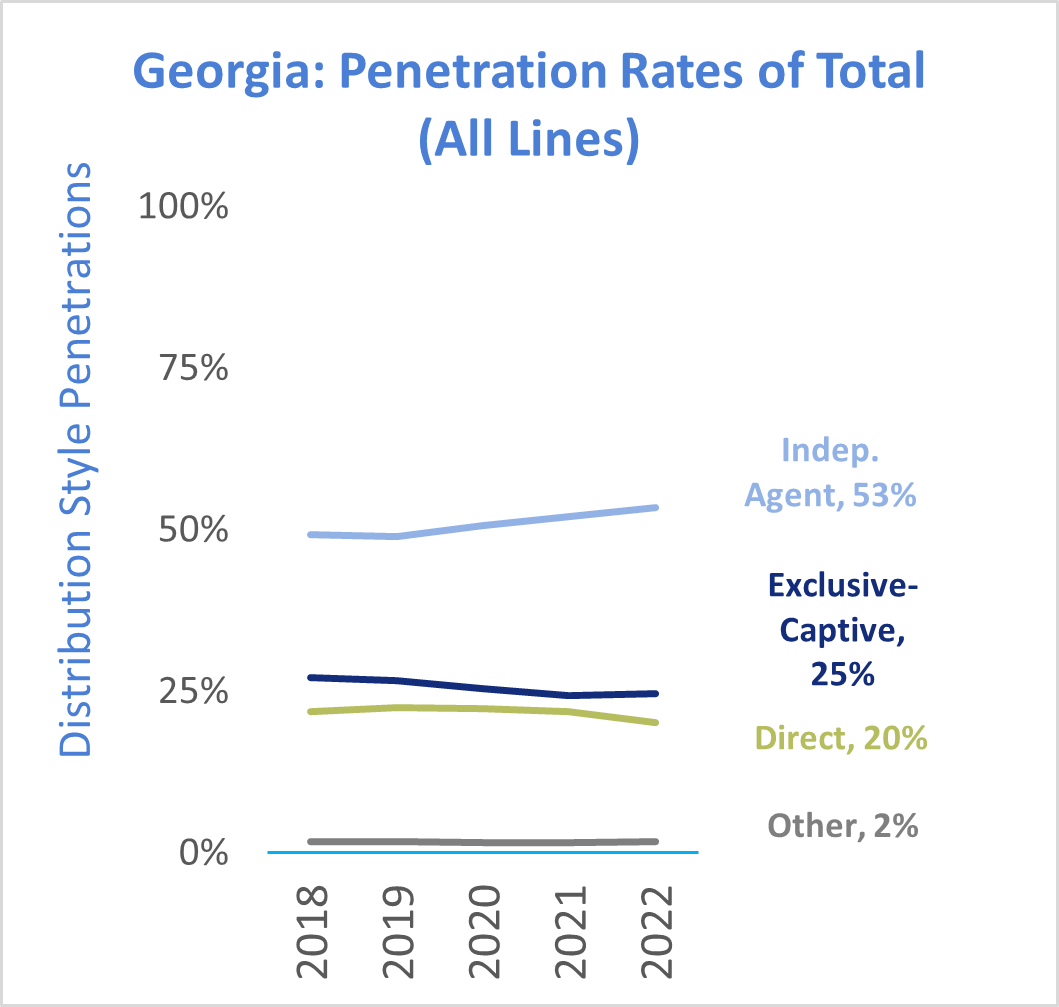

According to the IIAG 2023 P&C Marketplace Report, approximately half of the insurance market in Georgia is commercial lines and the other half is personal lines. Independent agents account for distributing 53% of all premiums and a whopping 86% of all commercial insurance premiums.

The top four lines in Georgia are:

-

- Personal auto insurance (39%)

- Homeowners insurance (16%)

- Commercial liability (10%)

- Commercial Auto (9%)

The Business of Insurance

Most insurance companies operate in a variety of states, affording them geographic spread of risk. The diversity of geography combined with the diversity of product lines creates spread of risk and insulates insurance companies from volatility in performance on any one line of coverage they may have. Every state has its’ own regulations and laws, not to mention court interpretations of contracts. Insurance companies consider these factors as well as profit capability when determining where they will deploy their capital and accept marketplace risks. We as an industry must be willing to admit that profit is not a dirty word, and financial viability is critical to the health and future of the Georgia insurance marketplace. After all, improved performance, or "profits," for insurance companies in Georgia will ultimately drive increased competition in our market, thus lowering rates.

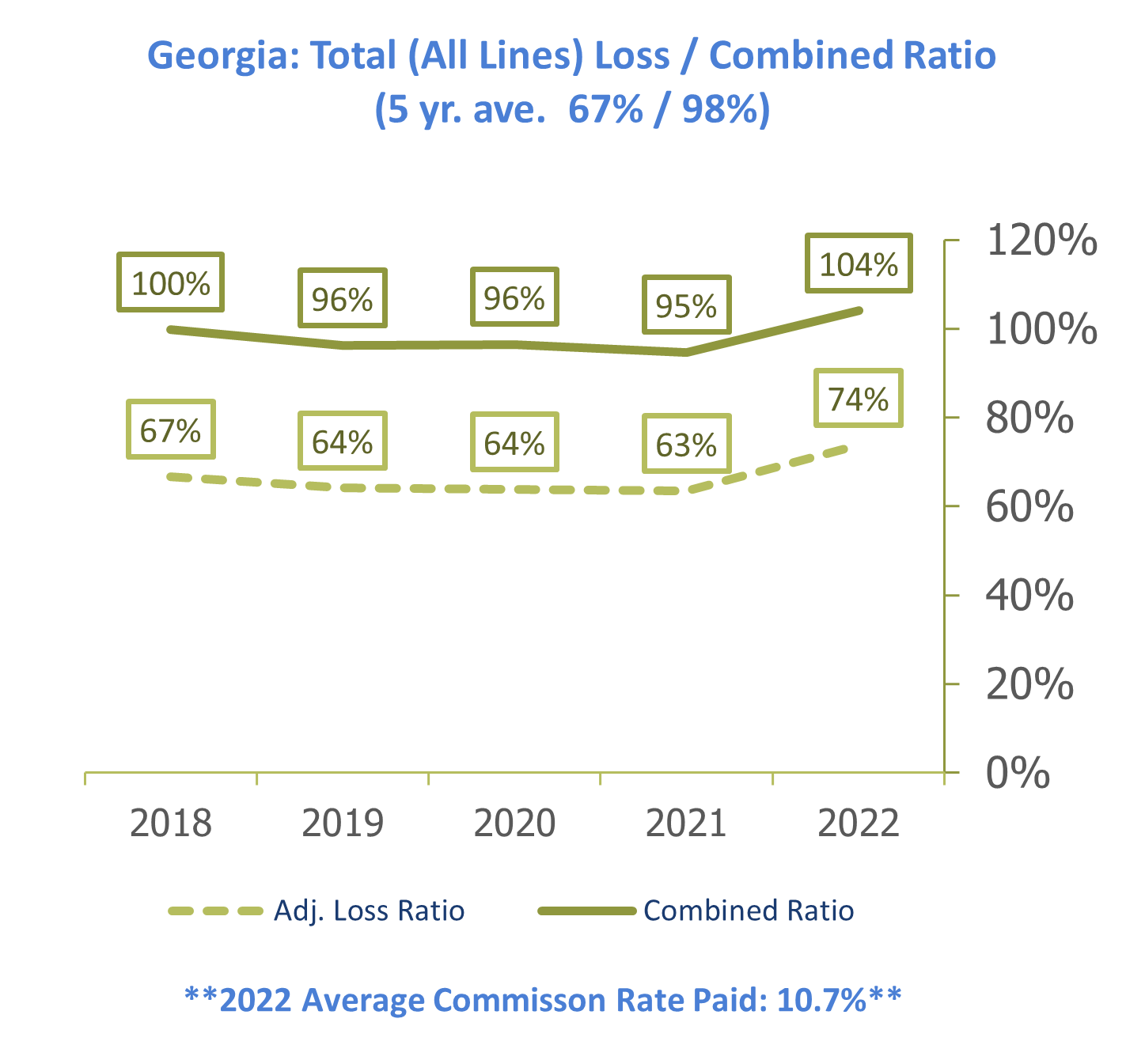

The most recent IIAG P&C Marketplace Report shows a 5-year pure loss ratio (excluding insurance company operating expenses) of 67% with the national average at 63%. The one-year loss ratio for all lines in Georgia is 74% and the national average is at 68%. This means the performance in Georgia has declined at a higher rate than the average for the nation.

The single shining star in Georgia is workers’ compensation with a pure loss ratio of 41%. It is important to note that this line comprises only 7% of all insurance premiums.

Commercial auto and private passenger auto comprise roughly 48% of all premiums and agents and consumers have seen rates rising rapidly. Even with these rate increases, the results suggest these increases are being outpaced by claims.

Profitability Trends of the Georgia Insurance Marketplace

Commercial auto rose from a 106% combined ratio in 2021 to 114% in 2022 while private passenger auto rose from 99% in 2021 to 113% in 2022. The auto liability lines in Georgia have been unprofitable nine out of the last 10 years, according to NAIC data.

The next largest line of business is homeowners, which in total, rose from just over $4 billion in premiums for 2021 to nearly $4.6 billion in premiums in 2022. However, this line is showing a 106% combined loss ratio, even after consistent annual premium increases.

Occurrence based liability policies are seeing a 121% combined loss ratio in 2022 which is a full 22 points worse than the national average.

What Is Driving All These Issues? How Is The Insurance Market Responding?

Inflation is certainly playing a part across the nation. Repair times for all types of losses have increased dramatically and the shortage of parts and materials is taking its toll. Georgia has not been immune from this, but this does not account for Georgia being worse than the national average.

Georgia has witnessed multiple billion-dollar claim settlements built on strategies from court rulings such as public liability, Holt demands, and trucking direct action (naming the insurance company as a defendant). Undisclosed litigation funding and a host of other strategies are becoming much more common as trial attorneys seek to maximize a claim.

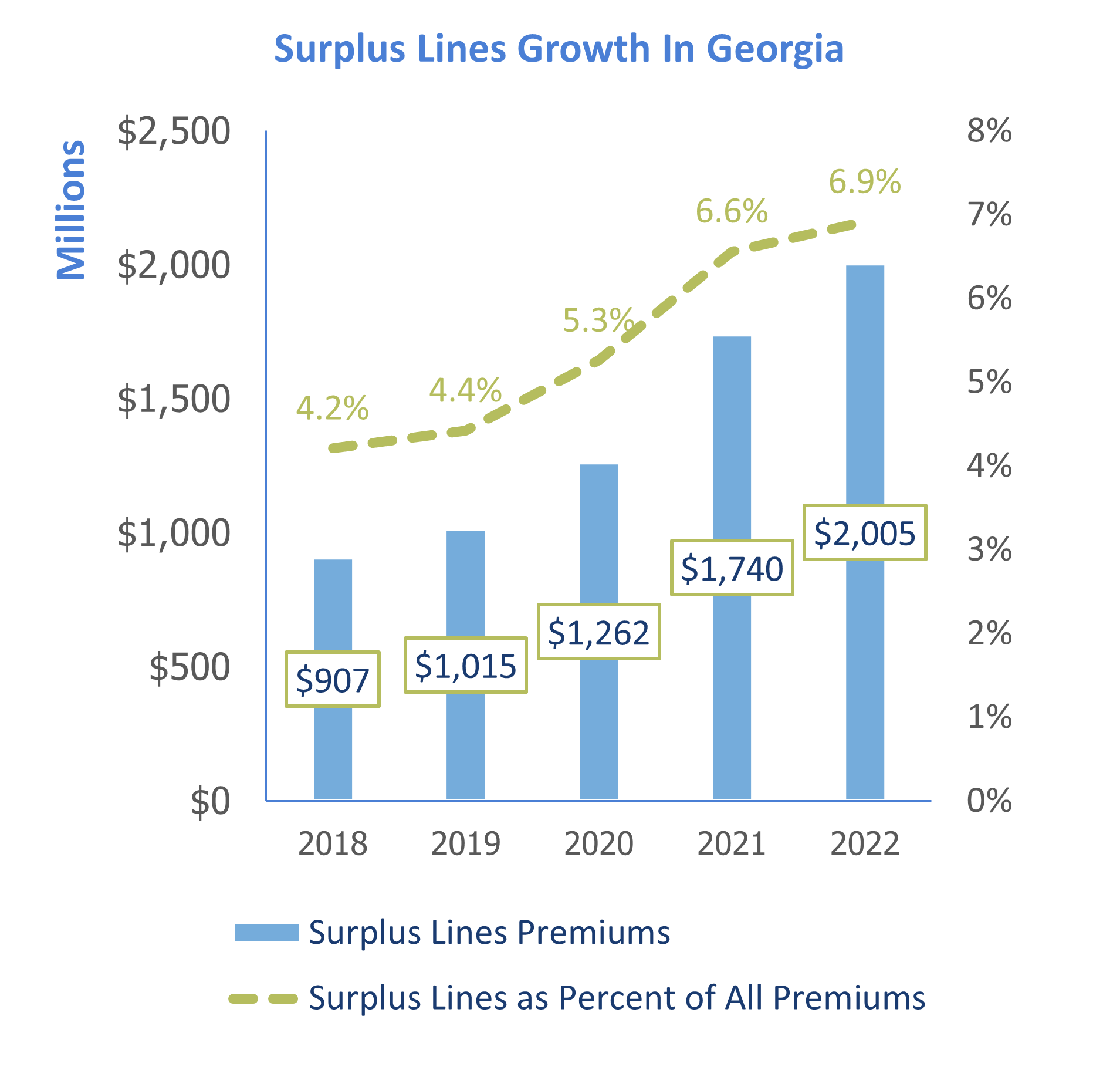

As a direct result of decreased profitability and claims volatility, the surplus lines markets have continued to grow at an accelerated rate. For the first time in 2022, we saw surplus lines premiums exceed $2 billion in Georgia, an increase of over $265 million from 2021, and all indications are that 2023 will show continued growth.

What Does This Really Mean Looking Forward for our Clients and our Economy?

Insurance coverage rates will continue to increase and the terms on the coverage offered will continue to deteriorate. It is common to see assault and battery exclusions on certain business sectors that simply were not there in the past. Nuclear verdicts come with a cost to all Georgians and that cost is rate increases for Georgia consumers. Although independent agents will most likely gain from this marketplace, it comes at a cost to our clients, and our communities.

FIGHT FOR YOUR INDUSTRY

Our all new Agents Action Center is a resource hub that will empower you to be an advocate for your clients in the fight for lawsuit reform.

The June 30 Georgia Supreme Court ruling has increased the liability for property owners with regards to any crimes that may be committed on their property without any guidelines for these property owners that may offer some protections. All signs from this ruling are that coverage will continue to deteriorate with additional exclusions and sub-limits on certain coverage that was formerly provided at full policy limits. We as agents must have discussions with our clients early and share the contributing factors to this difficult market where rates are climbing sharply.

Will Tort Reform Legislation Create Change and How Long Will it Take to See the Effect?

We may look to our neighbors to the south for this answer. Florida has been one of the most litigious states in the nation leading to a moment of change. Elected officials chose to take on tort and many wondered if it would bring about immediate savings regarding insurance premiums. Upon passing Florida House Bill 837, law firms in Florida filed nearly 3.6 million cases, in just one month, ahead of the law taking effect, all were seeking to have their case tried under the old statute. Some Florida attorneys declared the new law was an attack on their livelihood.

It is evident that it will take time for these lawsuits to work their way through the system in Florida and as these cases lift, meaningful reforms will begin to ease the claims trend lines.

To be abundantly clear, the insurance marketplace’s rate and coverage crisis will not disappear in the flip of a switch via favorable legislation. In our tort system, various statutes of limitation are applicable to certain torts. There will be a run-out period we will have to endure post potential improved legislation passing. Once this period has expired and the legislation has had time to season, barring any unforeseen factors, the marketplace should show signs of improvement.

The data in the IIAG Georgia P&C Marketplace Report illustrates the difficulty across a host of lines of coverage and a claims trend line that is extremely difficult to match with premium increases. It is easy to demonize insurance companies and think that there is no impact to society from these verdicts. However, the artificially inflated additional losses that are ubiquitous in our tort system will continue to add to consumer costs, decrease availability of coverage, and will have a negative impact on insurance carrier’s appetite to write insurance coverage in Georgia.

Without change, we can expect insurance companies to make difficult business decisions just as CVS and a variety of retailers have had to do in other venues. IIAG stands behind Governor Brian Kemp in his efforts to enact meaningful lawsuit reform in the 2024 legislative session. Our association’s primary mission is to protect the Georgia insurance marketplace, and we will need the engagement of all members to help educate our policymakers on the state of the Georgia marketplace and the consequences of inaction. ![]()

This article was originally posted in IIAG's Magazine, The Dec Page Quarterly (Winter 2023). You can view the original article here.